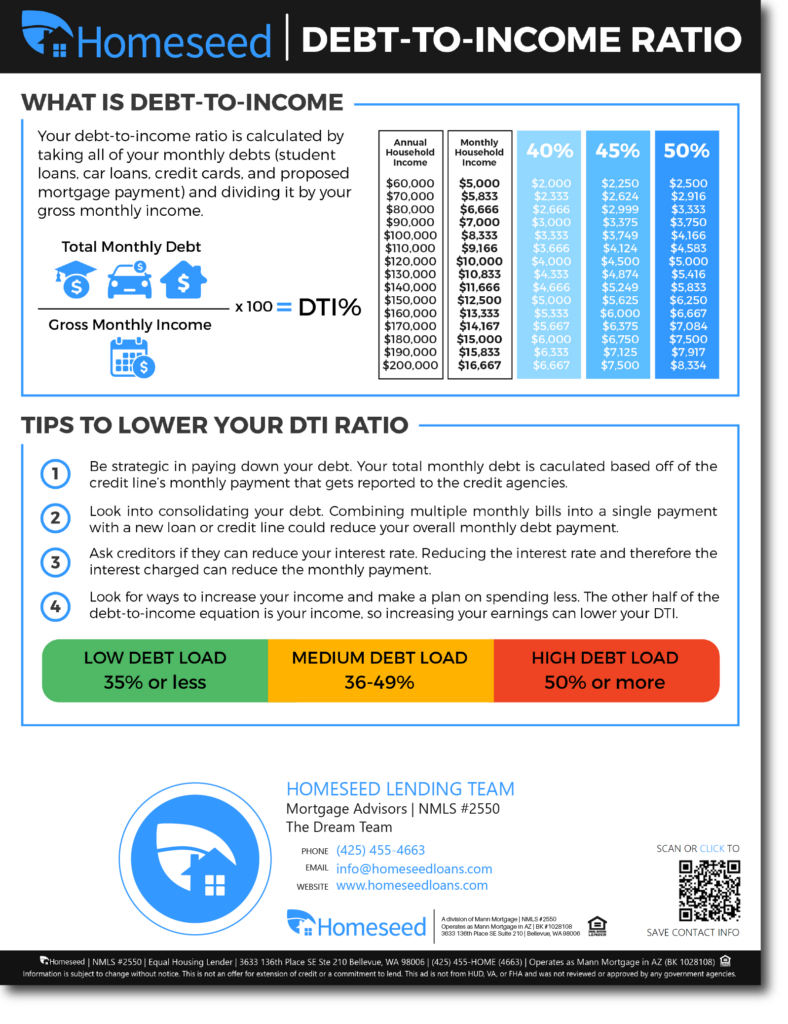

Maintaining a low debt-to-income ratio is crucial when applying for a mortgage due to its significant impact on your financial health and loan approval chances. The debt-to-income ratio is a measure of the percentage of your monthly income that goes toward paying off debts, including credit card balances, student loans, car loans, and your proposed mortgage payment. Lenders carefully consider this ratio as it provides an indicator of your ability to manage additional debt responsibly. By keeping your debt-to-income ratio low, you demonstrate financial stability and a higher capacity to handle mortgage payments. This lower ratio not only increases the likelihood of mortgage approval but also allows you to secure more favorable loan terms and interest rates. Overall, maintaining a healthy debt-to-income ratio is essential for a smooth mortgage application process and a solid foundation for your future homeownership journey.